The above image is an illustrative representation, created with AI and does not depict actual individuals or events.

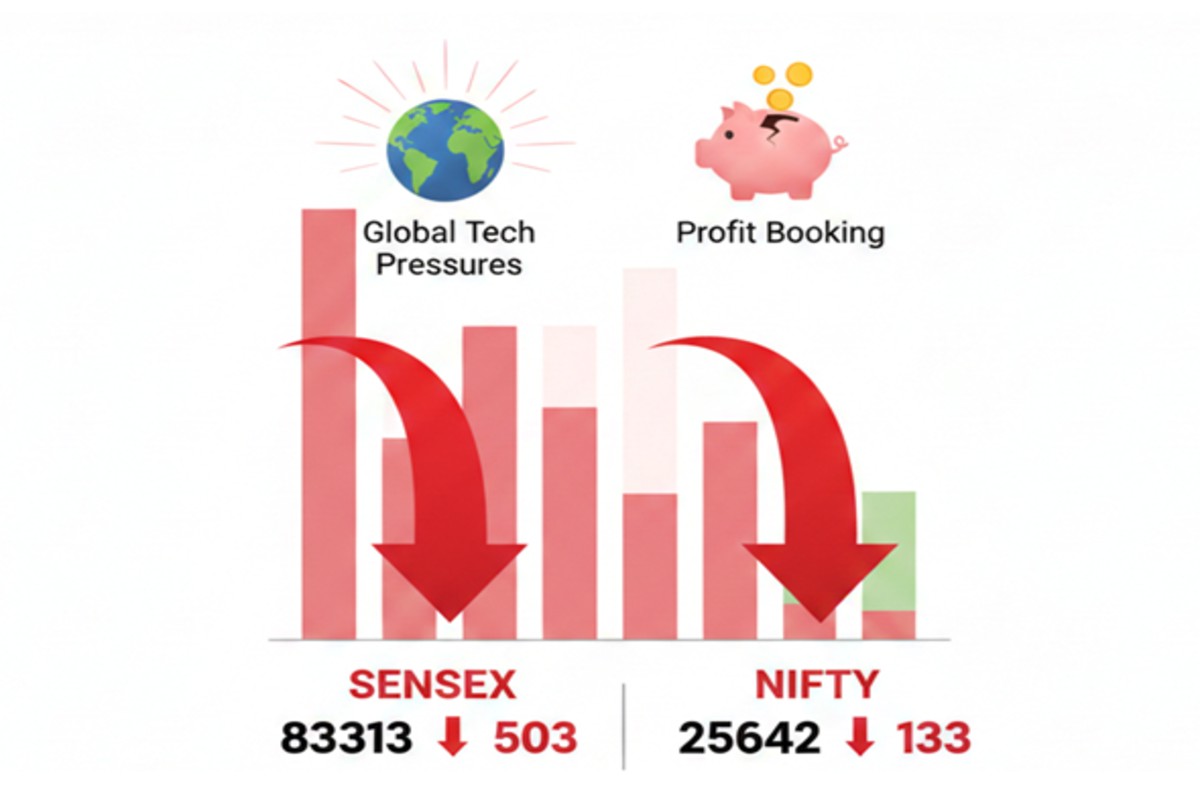

February 5, 2026, Mumbai : The Indian equity markets faced a challenging session on Thursday, snapping a three-day rally as benchmark indices settled in the red. The Sensex dropped 503 points to finish at 83313, while the Nifty 50 slipped 133 points to end at 25642. Investors adopted a cautious stance, influenced by a combination of weak global cues and a wave of profit-taking following recent gains. The primary indices saw a decline of roughly 0.6 percent, with the broader market sentiment reflecting the unease felt across Asian and Western exchanges.

The downturn was largely catalyzed by a significant sell-off in the global technology sector. Volatility in international markets spilled over into the domestic space, which struggled to find its footing throughout the day. Investors appeared to be reassessing valuations in the wake of emerging automation tools and their potential impact on traditional service models. Additionally, weaker-than-expected global employment data contributed to the risk-off mood, prompting participants to pull back from more aggressive positions.

Sectoral performance remained predominantly bearish, with metal and energy sectors facing the steepest declines. Banking and financial services, which had shown relative resilience earlier in the week, also succumbed to the broader market retreat. Despite the overarching negativity, a few pockets of the market managed to buck the trend. Domestic consumption-driven segments showed glimpses of stability, supported by recent growth-oriented policy announcements and favorable trade agreements signed earlier in the week.

On the institutional front, activity remained relatively muted. Domestic institutional investors continued to provide a cushion to the market with net purchases, while foreign portfolio investors also recorded marginal buying. However, this domestic support was insufficient to overcome the heavy selling pressure triggered by global headwinds. Technically, the market is now navigating a consolidation phase after testing key resistance levels. For now, the focus shifts to the upcoming central bank policy decision to determine the next directional move for the indices.